Source: http://mycpf.cpf.gov.sg/CPF/About-Us/Intro/Intro.htm

5% risk free interest rate! I don’t think you can find a better offer out there in the market. To maximise your savings in the CPF, I would recommend the following:

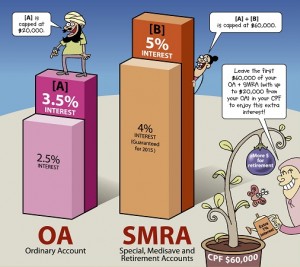

- Maintain $60,000 in your CPF. You should at least maintain $20k in your OA and another $40k in your Special, Medisave and Retirement Accounts (SMRA). As OA is more liquid and if you do not have $20k in your OA, do try to maintain at least $60k in your SMRA so as to enjoy the extra 1% interest. To give you a better sense of what the extra 1% can mean to you – 1% interest on $60k for a year is $600 and when compounded over a period of 10 years, you can get about $6300 in interest. So if you have $60k in your SMRA earning a 5% compounded interest, you can double your principal to $120k in about 14.5 years. Hence, do note that if you want to invest your OA and SA, it is advisable to invest your OA and SA only if you have excess of $60k in your CPF accounts. Else you may be better off keeping the money in your CPF and enjoying the additional 1% interest rate.

- Voluntary Cash Top Up to CPF. If you have excess cash on hand and is not into investment. It may not be a bad idea to make cash top up to your CPF to make up to the $60k limit. I’m coming purely from the angle that your money is better in the CPF than leaving it idle in the bank where you are getting much more interest and the money in your CPF can be used for future retirement planning.